This information was originally sent to all GAs on an F-1 or J-1 visa on February 21, 2024 and will be sent out again before the end of the spring 2024 term. If you are not graduating this spring, this information will not apply to you, but is still important to understand for the future.

Dear International Huskies,

Federal government regulations allow graduate students on F-1 and J-1 visas to hold on-campus employment while they are pursuing their degree. If you complete your degree requirements during Spring 2024 and if your degree is conferred in May, you will no longer be pursuing your degree after May 5, 2024.

If you hold an Academic Year 2023/2024 or Spring 2024 appointment at Storrs or a regional campus (excepting UConn Health), the final date of your appointment is May 21, 2024. If your degree is conferred in May and you hold an F-1 or J-1 visa and your assistantship appointment is covered by a collective bargaining agreement with the Graduate Employee Union (GEU), the time from May 4, 2024 through May 21, 2024 should be treated as time off. Please work with your supervisor to ensure you finish the duties associated with your assistantship before May 4, 2023. You will still receive your full Spring 2023 GA stipend.

In addition, ISSS will be updating your I-20 or DS-2019 program end date to May 4, 2024 if you are graduating in May and hold a GAship this term. This means your grace period to depart the U.S., or your first eligible date to begin post-completion practical training will begin May 5, 2024. Please plan for this accordingly. ISSS will adjust your I-20 or DS-2019 end date automatically based on notification that you have applied for graduation, or at the time you apply for post-completion OPT (F-1 students) or Academic Training (J-1 students), whichever comes first. ISSS will notify you when your adjusted I-20 or DS-2019 is ready to download from your ISSS portal account later in May.

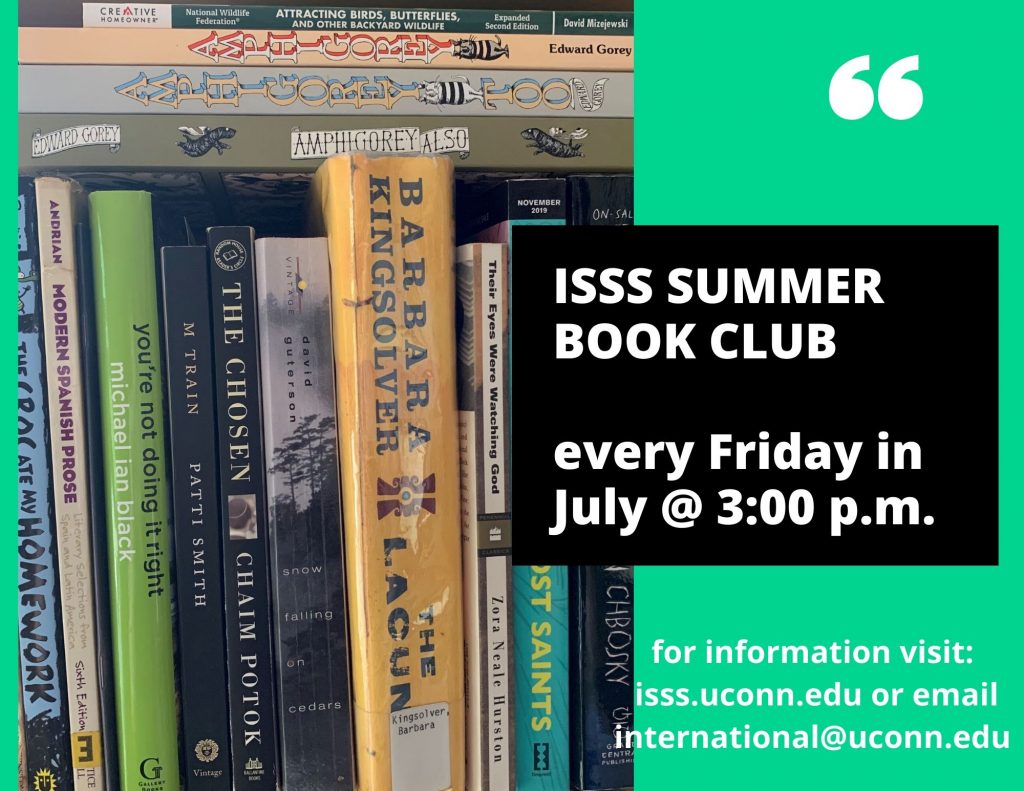

Please reach out to ISSS at international@uconn.edu if you have any questions about this change as it relates to your visa status, I-20, grace period, or practical training timeline.

Kent Holsinger

Board of Trustees Distinguished Professor of Biology

Vice Provost for Graduate Education

and Dean of The Graduate School

Arthur Galinat

Director, International Student and Scholar Services